Cash Balance Plan Experts

Jeffrey R. Mason

Managing Director

Christopher L. Hammond

Managing Director

Path to Massive Annual TAX Deductions

For Business Owners & Professional Practices

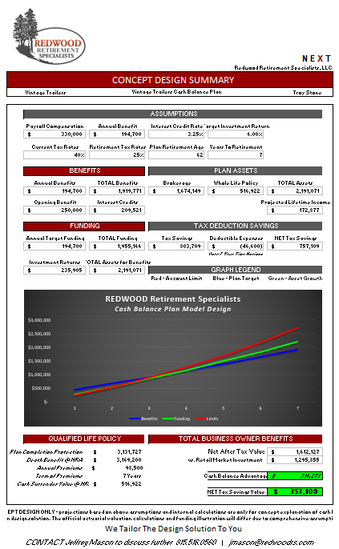

Concept Design Software

Get your free Concept Design NOW

To see how you can take annual 6-figure Tax Deductions on your business

Our Redwood model solution is superior to a standard cash balance plan, showing:

- Path to maximum owner benefits modeled with our N E X T software

- High value proposition of costs to owner benefits demonstrate

- Covered protection during nest egg accumulation

- Optimum latitude and flexibility for annual funding

- Stable low volatility investment policy for maximum control & tax reduction ROI

- Optimized compensation plan for maximum limits and greatest payroll tax reduction

Tailored to your business success for immediate & long-term favorable tax impact

About Jeff

Working in the retirement plan field for over 25 years, Jeff is a founding owner of two actuarial consulting firms and a licensed life agent. Jeff drives business solutions by forming strong relationships with Tax Specialist CPA’s, Financial Advisors, and business owners.

He understands the tax burden business owners are saddled with and works with these groups to illuminate a solution that dramatically cuts the current tax bill year after year and instead leverages those obligations to fuel a muti-million dollar nest egg for retirement, and protecting business owners with our innovative solutions.

815.516.0560

jmason@redwoodrs.com

Our Offer

Tailored Design

Solution is fit to your tax reduction needs and the operation of your professional practice or business.

Our model will show you the full advantage of this solution net of all costs and illuminate the dramatic tax savings you are able to realize.

Planning Expertise

We built our N E X T planning software to model your plan and show you the full scope of latitude our solution affords you over your entire retirement plan time horizon.

The degree of control is unparalleled.

Annual Actuarial

Our firm designs, implements, and manages your IRS tax-advantaged solution annually, ensuring all IRS filings and compliance with retirement and tax law, certified by our team of actuaries and consultants. We work and adapt with your business and objectives.

About Chris

30 years in the retirement plan field. Chris is co-owner with Jeff in two actuarial consulting firms, a licensed life agent, and a licensed investment advisor.

Driven by an intense need to formulate a highly adaptable solution for business owners, Chris engineers our N E X T planning model and provides ongoing consulting to our clients. Working directly with our actuaries and doing a deep dive on annual actuarial valuations and funding illustrations, he guides our clients with the solution model and carefully educates them to understand how to navigate it.

With the constant barrage of high taxes and cashflow considerations, Chris makes sure to position our clients for optimal success.

608.298.5232

chammond@redwoodrs.com

CASH BALANCE PLAN

An IRS tax qualified retirement plan

Allows business owners to rapidly build their NEST EGG

• Dwarfs owner contributions to a 401(k) Profit Sharing Plan

• 6 to 7 figure annual tax-deductible employer contributions

• Multimillion-dollar cap on what can be accumulated per owner

• Combined with Profit-sharing plan to leverage for maximum owner benefits

• Permanent tax deductions for benefit contributions to employees

TEAM APPROACH

Our team of actuaries, analysts, and plan consultants tune our solution model to your needs. Not only when built on the front end, but year to year as we administer the plan & consult in conjunction with your team of advisors, agents, and CPA’s. The mission of Redwood Retirement Specialists is reducing tax liabilities of small business owners & professional practice owners while accumulating wealth.

Our expertise is in leveraging Cash Balance pension plans for your benefit in the most tax effective way, better than anyone else.

We Tailor The Design Solution To You

CONTACT Jeffrey Mason to discuss further 815.516.0560 | jmason@redwoodrs.com

Please Reach Out

Proposal Request Forms

Book A Call

Office

4320 Spring Creek Rd. Suite 114 Rockford, IL 61107

jmason@redwoodrs.com

815.516.0560

Redwood Retirement Specialists, LLC